If you're a veteran utilizing a VA home loan, there's an uncomplicated method for refinancing that could result in potential savings.

Consider a VA streamline refinance, also known as a VA Interest Rate Reduction Refinance Loan (IRRRL). This option might help decrease your interest rate, reduce your mortgage term, or minimize your monthly payment, frequently without the need for an appraisal or credit underwriting.

Here’s what you need to know about VA streamline refinances:

- What is a VA streamline refinance (VA IRRRL)?

- VA streamline refinance loan benefits

- Drawbacks of VA streamline refinance loans

- VA streamline refinance eligibility guidelines

- VA IRRRL costs

- How to apply for a VA IRRRL

- Is a VA streamline refinance loan right for you?

What is a VA streamline refinance (VA IRRRL)?

If you are an active-duty military service member, veteran, or surviving spouse with a VA mortgage, you may be considering refinancing to reduce the interest rate on your current home loan.

An Interest Rate Reduction Refinance Loan (IRRRL) can assist you in achieving this by substituting your existing VA loan with a new one featuring a different interest rate, monthly payment, and possibly a different term.

What sets this refinance apart as "streamlined" is its typically simplified process with fewer steps and less paperwork. For instance, an appraisal or credit underwriting is usually not required by the VA for this loan, leading to a faster closing time compared to a conventional refinance.

Related Article

FHA Streamline Vs. Cashout: What's the difference?VA streamline refinance rates

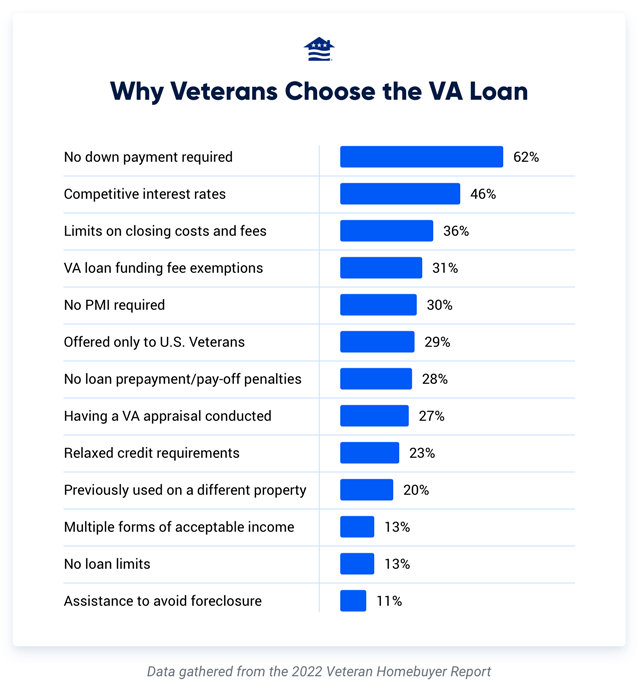

The 2022 Veterans Homebuyer Report asserts that the interest rates associated with VA loans typically exhibit a reduction of 0.5% to 1.0% compared to the interest rates seen in conventional mortgages. Lending data provided by ICE Mortgage Technology for the period spanning January through August 2021 indicates that VA loan rates were approximately 0.3 percentage points lower than those of conventional loans for a 30-year fixed-rate mortgage.

Good to know: Though somewhat informative, broad figures like these won't indicate the specific type of mortgage that will yield the best rate for you. The rate you receive is personalized and contingent on your financial circumstances, as well as the prevailing conditions in the mortgage market at the time of your application.

Rates also differ based on the mortgage lender, loan term, and the amount of home equity you possess. For instance, if you have a minimum of 20% equity and meet the criteria for underwriting and an appraisal, you may discover a more favorable interest rate and lower APR by refinancing into a conventional loan, even if you are eligible for an IRRRL.

Obtaining pre-approval from Peoples Bank & Trust Company will provided you with the most accurate insight into the rates you qualify for. It also enables you to compare loan costs and experience the level of customer service offered by us before committing to the mortgage approval process. At Peoples Bank & Trust Company, we can assist you in finding a competitive rate if you are refinancing a conventional loan.

VA streamline refinance loan benefits

A VA streamline refinance has several appealing advantages:

- Competitive rates: VA loan rates typically mirror or slightly undercut conventional loan rates.

- No private mortgage insurance: Even with less than 20% equity, VA loans don't require private mortgage insurance (PMI) like conventional and FHA loans.

- No appraisal: Opting for a no-appraisal refinance not only saves upfront costs but also allows for refinancing a home that has depreciated in value.

- Less documentation: The streamlined nature of a VA refinance means you can skip the underwriting process, eliminating the need for extensive documentation like bank statements and tax returns.

- Closing cost financing: Roll your closing costs into the new loan to avoid out-of-pocket expenses.

- Quick closing: The absence of underwriting and appraisal typically results in a faster refinancing process for your home.

- No occupancy requirement: You can streamline refinance a property that is no longer your primary residence.

- Catch up if you’ve fallen behind: If your VA loan is in arrears, an IRRRL with credit underwriting may help you catch up on overdue payments, settle late fees, and transition to a more affordable loan, stabilizing your financial situation.

Good to know: The lending criteria set by the VA for an IRRRL do not mandate credit underwriting or an appraisal, but they also don't prohibit it. Lenders may choose to assess your credit or arrange for an appraisal, and if they opt for such steps, they are permitted to pass on the associated costs to you.

Drawbacks of VA streamline refinance loans

Even though a VA streamline refinance is meant to be money-saving and efficient, you should understand how its drawbacks might affect you:

- Funding fee: Each time you secure a VA loan, a funding fee is applicable, amounting to 0.5% of the loan for an IRRRL.

- Existing VA loan required: If you currently hold a conventional or FHA loan, you do not meet the eligibility criteria for an IRRRL. However, you might qualify for a VA cash-out refinance.

- Closing costs: Anticipate incurring fees for loan origination, title insurance, and adherence to local government requirements.

- Restarting your loan term: When refinancing, many borrowers opt for the same loan term. For instance, if you've been paying a 30-year loan for four years, you'd have 26 more years to go. However, if you refinance into a new 30-year loan, you'll be restarting the loan term.

- No cash out: IRRRL does not permit borrowers to extract equity unless the funds are reimbursement for energy-efficient home improvements completed within 90 days of closing, with a cost not exceeding $6,000.

- Waiting period: To be eligible for an IRRRL, you must have held your existing VA loan for 210 days and made six consecutive monthly payments.

Tip: Prevent resetting the duration of your loan by either opting for a shorter term during refinancing or making advance payments towards the principal on your new mortgage. In the event that you refinance into a shorter term, and the resultant payment is at least 20% higher than your current one, you will be required to undergo underwriting.

VA streamline refinance eligibility guidelines

Qualifying for a VA streamline refinance can be easier than qualifying for other refinance loans. Here are the key criteria and a brief explanation of each one:

| Requirement | Description |

|---|---|

| You’re refinancing a VA loan | You can’t use a VA IRRRL to refinance a conventional, FHA, or USDA loan. |

| You’re no more than 30 days behind on payments | If you’re more than 30 days behind, you’ll have to go through underwriting. |

| The home has been your primary residence | It’s OK if your home is not your primary residence anymore or won’t be after you refinance, as long as it was previously. |

| Your new loan won’t push back your payoff date by more than 10 years | For example, if you have 12 years left on your VA loan, your new loan term can’t be longer than 22 years. That means you wouldn’t be able to refinance into a 30-year loan. |

| Your new loan will have a lower interest rate | One exception: You can refinance into a higher rate if you’re refinancing an adjustable-rate mortgage (ARM). |

| You don’t want to cash out any equity | There’s no cash-out refinance option with an IRRRL. Look into a VA cash-out refinance instead. |

VA IRRRL costs

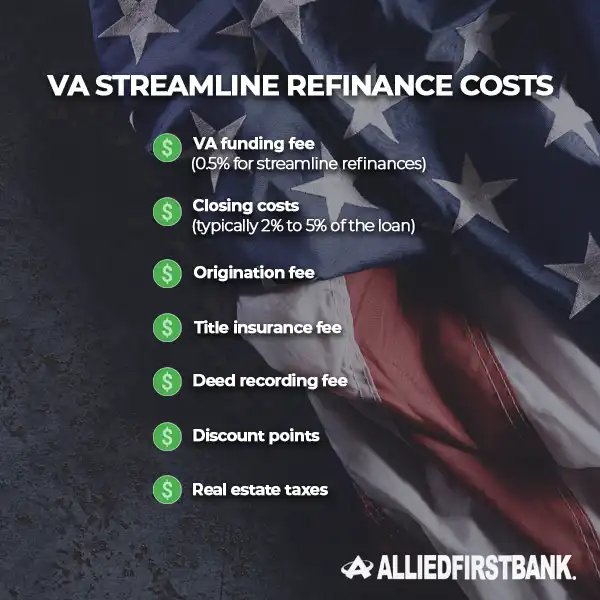

The closing expenses for a VA streamline refinance closely align with those of other VA loans. Nonetheless, you probably won't need to cover the cost of an appraisal, resulting in a savings of a few hundred dollars. Here are common closing costs linked with a VA IRRRL:

Closing costs typically vary from 2% to 5% of the loan amount. Most borrowers incur charges such as an origination fee, title insurance fee, and deed recording fee. Additionally, there may be local taxes, varying in cost across different regions. Some borrowers opt to prepay mortgage interest by using points in exchange for a reduced interest rate.

A distinctive closing cost associated with VA loans is the VA funding fee, which stands at 0.5% on an IRRRL or $500 for every $100,000 borrowed. Exemptions may apply if you're receiving payments for a service-connected disability or if you've earned a Purple Heart.

Rolling closing costs into your VA IRRRL

An IRRRL permits the inclusion of closing costs in the loan, which can be advantageous if you anticipate substantial savings from refinancing but lack immediate cash. This option may also be strategic if you plan to sell your home upon receiving permanent change of station (PCS) orders. Investing a significant upfront amount for a short-term loan may not be a sensible choice.

To illustrate, on a 30-year mortgage, consider the additional amount you would pay throughout the loan's duration by rolling $12,000 in closing costs (4% of $300,000) into the loan instead of paying them upfront.

| Interest rate | Pay closing costs up front | Roll closing costs into loan | Additional cost |

|---|---|---|---|

| 3% | $12,000.00 | $18,345.30 | $6,345,30 |

| 4% | $12,000.00 | $20,721.16 | $8,721.16 |

| 5% | $12,000.00 | $23,388.64 | $11,388.64 |

Although inflation is typically perceived negatively, it can work to the advantage of individuals with fixed-interest-rate mortgages. Over time, even mild increases in prices and incomes can create the perception that your mortgage debt is becoming more affordable.

To put it differently, while an additional $6,300 might seem substantial at present, its impact will diminish each year due to inflation. Nevertheless, it's essential to note that the desirability of borrowing may decrease as your interest rate rises.

How to apply for a VA IRRRL

If you apply for a VA IRRRL, the process will look something like this:

- Identify well-established lenders providing VA streamline refinance options.

- Complete a pre-approval application either online or by phone with a minimum of three lenders.

- Evaluate the Loan Estimate received from each company, seeking the most favorable terms for your specific situation.

- Determine the number of points, if any, to pay in order to reduce your interest rate.

- Once satisfied with the prevailing interest rates, secure your rate by locking it.

- Furnish any necessary supporting documents as requested by your lender. Usually, your lender can obtain your VA loan certificate of eligibility (COE) on your behalf.

- Sign the necessary paperwork to finalize and close on your loan.

Is a VA streamline refinance loan right for you?

Consider refinancing your existing home loan into a new one, especially if you can secure a reduction in your interest rate by at least one percentage point. It is also a prudent choice if you anticipate retaining the new loan long enough to recoup the closing costs.

Opting for a VA streamline refinance, in particular, might be a suitable option if you are facing challenges such as job loss, a decline in your credit score, reduced income, or a decrease in your home's value. As IRRRLs do not mandate an appraisal or credit underwriting, this type of refinance could serve as a lifeline in challenging times, helping you retain your home.

Tip: If you’re struggling to pay your mortgage, contact the Department of Veterans Affairs. They will assign a loan technician to help you.

Refinancing may not be beneficial if you have imminent plans to relocate or are unable to secure a lower interest rate. However, if you possess at least 20% equity, maintain good credit, and have a stable income, it's advisable to explore quotes for both an IRRRL and a conventional refinance.

Irrespective of the refinance type you choose, obtaining quotes from various lenders is crucial for potential cost savings. Peoples Bank & Trust Company can assist you in accessing customized, prequalified rates for a VA Streamline refinance (IRRRL). Importantly, checking rates with us does not impact your credit score.